Dear Reader,

You hear a lot about it in the trending headlines these days: War with China.

And from a marketing standpoint, perhaps it makes sense.

After all, in an environment where it seems like we’re closer than ever before to a full-scale armed conflict with an enemy long since thought neutralized, it’s only natural that those who think of themselves as forward thinkers would already be looking for the cause of the next war.

From most other standpoints, however, I just don’t see it… and the primary reason goes straight to motive.

In 2022, the Chinese Communist Party, ruling party of the People’s Republic of China, presided over $1.2 trillion worth of exports to the U.S. and its NATO partners in Western Europe.

That’s more than twice the volume of goods exported to China’s next door neighbors, the nations of ASEAN (Association of Southeast Asian Nations), which encompasses 10 countries, 600 million people, and 4.5 million square kilometers.

Why on Earth would China risk physical devastation, as well as almost certain financial ruin, by setting foot anywhere near armed hostilities with by far its biggest market for consumer goods?

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

Technology Metals… China's Real Battleground

The answer is it wouldn’t. Not in the bombs-and-bullets concept of war, anyway.

The Chinese war on the West has been waging for at least the last 30 years, as it began buying up processing and production capacity to manufacture an element that’s as important today as oil and coal were 120 years ago.

I’m talking about lithium, the building block of the modern-day rechargeable battery cathode.

While we’ve been all too eager to push forward a society built on universal access to seamless, wireless information sharing, the power source behind it has quietly become the most important industrial metal in common usage today.

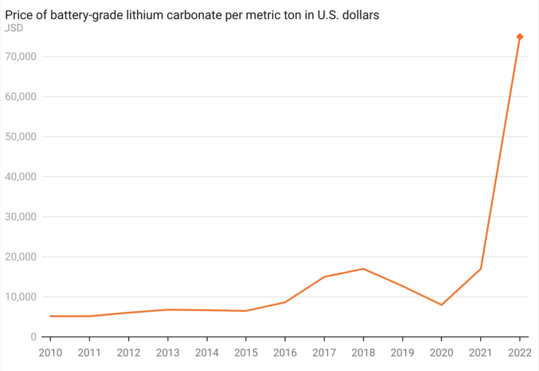

One look at lithium prices over the last 10 or so years tell the whole story.

And it’s just getting started.

With most of Europe and the U.S. now mandating the end of ICE-driven vehicle sales starting as soon as 2025 (Norway), the coming of the EV revolution is no longer a matter of when.

Our own president publicly backed a 50% EV market share across all new automotive sales by the end of this decade.

Whom Do EV Mandates Serve?

This may sound exciting, but it's far from straightforward.

There are plenty of potential pitfalls along the way, and perhaps the biggest is the very source of all that lithium.

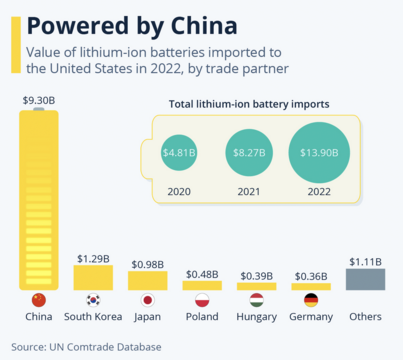

Unfortunately, unless things change, we’ll be mostly reliant on Chinese lithium and Chinese batteries when all of this happens.

Even Elon Musk, occasionally the richest man in the world, has to source his Tesla batteries from Chinese lithium-ion giant, CATL — the biggest battery-maker in the world.

The question is… What can and what will the Chinese do once they achieve the global lithium monopoly they clearly seek?

Will they raise prices? Will they limit exports?

The answer is: Any of the above. It will all be within their control.

But the one thing they probably won't resort to is armed hostilities.

Because why destroy your enemy when you can subjugate him?

One truth becomes abundantly clear even amid all the uncertainties: The need for more lithium battery production closer to home and away from Chinese interests is real.

A Rising Star in the Next-Gen Cathode Industry

Right now, a Vancouver-based advanced materials company is doing just that — developing home-grown lithium processing — but it’s taking things a few steps further.

This company isn’t merely offering Chinese-independent lithium processing. It’s creating some of the highest-quality lithium cathodes known to man, using less energy and a process that costs less overall than the current standard.

It's all possible thanks to a completely new manufacturing process that's already poised to upend the existing lithium industry.

The process that’s going to change everything for battery production starts with the synthesis of the cathode materials — which calls for the precise mixture of iron, cobalt, magnesium, carbon, nickel and, of course, lithium.

Traditionally, this required at least three separate processes, but with this new all-in-one method, the results aren’t just cheaper and faster, but better all around… all the way down to a microscopic level.

The resulting batteries will be on a whole new level in terms of performance and reliability — which is no small issue, with lithium-battery fires making national news headlines on a daily basis.

I’ve been following this company since its early days, but what it’s doing now is where things might get really interesting.

Unless the market takes a sudden and severe turn, shareholders of this stock could be among the biggest benefactors of the lithium battery rush.

If you want to learn more, just click below and watch the video that comes on.

Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.